Crack the Code to Wealth: From Failure to Fortune

Discover the critical reasons why many people struggle to achieve their financial goals and how to overcome these hurdles. Learn the importance of sacrifice, consistency, and strategic decision-making with your time and money to create lasting wealth.

Table of Contents

- Introduction

- The Essence of Sacrifice

- Building Generational Wealth

- Efficient Spending to Maximize Savings

- Avoiding Common Pitfalls

- Achieving Higher Returns

- Long-Term Financial Goals

- FAQ

- Become Part of Agent Wolfpack

Introduction

Success demands sacrifice. It's common to see people embark on a journey towards their goals, making sacrifices such as avoiding social outings, changing their peer groups, or breaking bad habits like excessive drinking. They commit to these changes for a short period, but often revert to old habits, undermining their progress. Achieving success and financial independence requires sustained sacrifice, not just a temporary effort. This blog post delves into why many fail to accumulate wealth at a young age and how adopting a long-term strategy of sacrifice can lead to financial success.

The Essence of Sacrifice

The main barrier to achieving wealth, and success in general, is the lack of sustained sacrifice. We all have activities we enjoy—partying, socializing, watching movies, or scrolling through social media. These activities, while enjoyable, often distract us from the tasks necessary for achieving long-term success. Sacrifice means consistently choosing to do what we need to do over what we want to do, even when it's difficult and especially when others around us are indulging in leisure activities. Success is a long-term strategy that requires perseverance.

Trading Time for Wealth

There are two primary ways to accumulate wealth: trading time and trading money. Initially, when you have no money, you must trade your time. For example, I had no money when I started and spent countless hours playing poker to earn money. Unfortunately, I squandered that money and had to start over. Many people believe that without money or financial mobility, they cannot achieve their goals. However, we live in an age where social media and technology provide opportunities to build financial freedom through sheer work ethic. The key is to trade your time efficiently to generate income quickly.

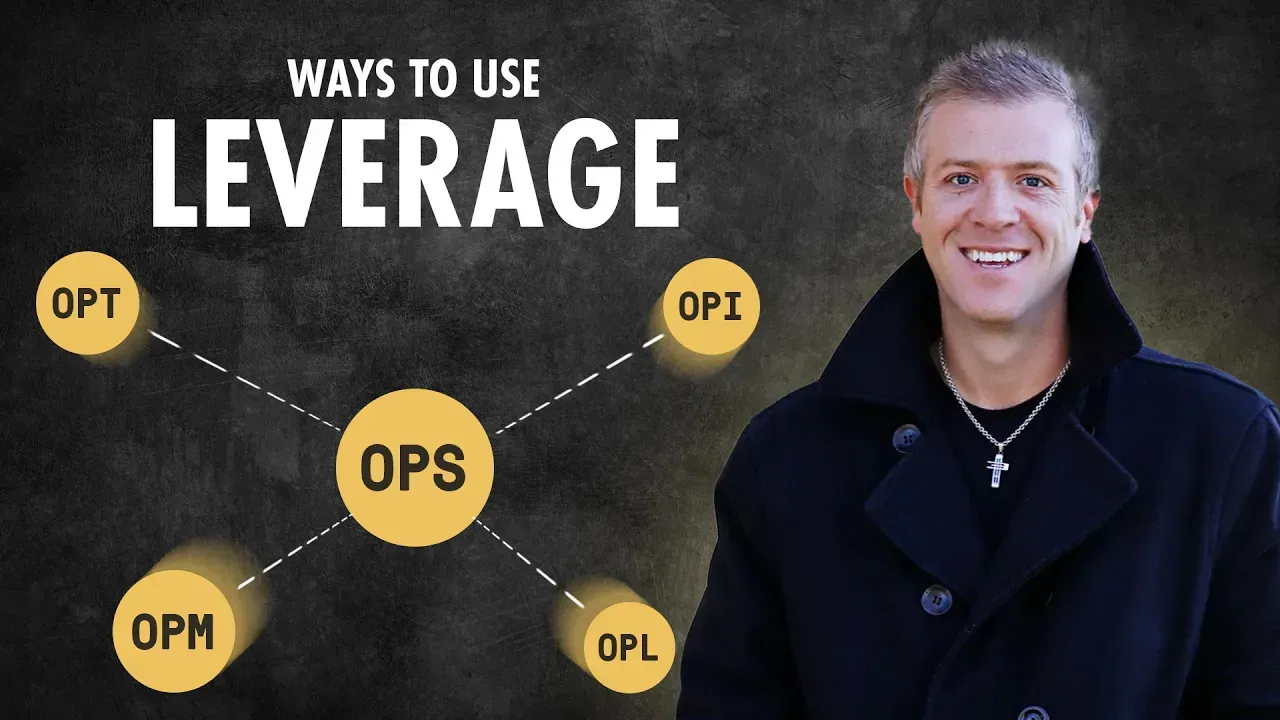

Leveraging Investments

As you accumulate wealth, you can leverage your money through investments to buy back your time. This balance of trading time for money and then leveraging money to buy back time is essential for creating generational wealth.

Disposable Income to Critical Mass

- Create a net income by trading your time as fast as possible

- Set aside funds for taxes and required living expenses

- Use the remaining disposable income to build towards critical mass, which is essential for creating generational wealth and financial freedom

Efficient Spending to Maximize Savings

When it comes to achieving financial success, efficient spending is crucial for maximizing savings and building lasting wealth. By making strategic decisions with your money, you can create a solid foundation for financial security.

Reduce Food Expenses

Food expenses can often be a significant drain on finances. By making simple changes, such as preparing meals at home and avoiding unnecessary takeout or fast food, you can save a substantial amount of money each month.

Minimize Living Expenses

Review your monthly bills and living expenses to identify areas where you can cut back. Whether it's negotiating lower utility bills, finding more affordable housing options, or reducing unnecessary subscriptions, minimizing living expenses can free up more money for savings and investments.

Create Disposable Income

- Minimize food expenses through home-cooked meals

- Review and reduce unnecessary living expenses

- Create a disposable income by prioritizing saving over unnecessary spending

Avoiding Common Pitfalls

When it comes to building wealth, avoiding common pitfalls is crucial for long-term financial success. Many people struggle with either wasting their time or mismanaging their money, and sometimes both. By being mindful of these common pitfalls, you can pave the way for a more secure financial future.

Time Management

Efficiently using your time is essential for achieving financial goals. Avoid wasting time on unproductive activities such as excessive TV watching or aimless scrolling. By prioritizing your daily activities and focusing on tasks that contribute to your long-term financial success, you can make the most of your time.

Financial Management

Managing your money wisely is equally important. Many individuals make a substantial income but struggle to build wealth due to poor money management. Avoid wasteful spending and prioritize saving and investing to ensure that your hard-earned money works for you in the long run.

Achieving Higher Returns

When it comes to achieving higher returns on your investments, it's essential to assess your financial habits and make strategic decisions with your time and money. By identifying areas where you may be overspending or investing poorly, you can pave the way for increased wealth accumulation and long-term financial success.

Evaluating Expenses

Take a close look at your monthly and annual expenses to identify areas where you may be overspending. This could include unnecessary subscriptions, excessive dining out, or wasteful spending on non-essential items. By cutting back on these expenses, you can free up more money for strategic investments.

Avoiding Bad Investments

One of the key factors in achieving higher returns is avoiding bad investments. Whether it's putting money into ventures that don't yield a return or making impulsive financial decisions, poor investments can hinder your wealth accumulation. By focusing on sound investment strategies and seeking professional advice, you can maximize your returns.

Compounding Your Wealth

Understanding the power of compounding is crucial for achieving higher returns. By investing your money in vehicles that offer significant compounding potential, such as tax-advantaged accounts and long-term investment opportunities, you can accelerate the growth of your wealth over time.

Long-Term Financial Goals

When it comes to creating long-term financial success, setting clear goals is crucial. By understanding the key milestones and strategies for wealth accumulation, you can pave the way for a secure financial future.

Creating a Compounding Amount

One of the key long-term financial goals is to create a compounding amount from your investments. This involves reaching a point where the income generated from your invested amount is significant enough to reinvest and create a compounding effect.

Investing for Generational Wealth

Another long-term financial goal is to invest strategically to create generational wealth. This involves making sound investment decisions that not only benefit you in the present but also set the stage for financial security for future generations.

Maximizing Returns and Wealth Accumulation

Ultimately, the long-term financial goal is to maximize returns and wealth accumulation. This includes identifying investment vehicles and strategies that offer significant compounding potential, as well as understanding tax advantages and leveraging investment vehicles to accelerate wealth growth over time.

FAQ

How can I start building wealth?

To start building wealth, you need to prioritize making sacrifices and consistent, strategic decisions with your time and money. By focusing on long-term financial goals and efficient spending, you can lay the foundation for lasting wealth.

What are some common pitfalls to avoid?

Common pitfalls to avoid include wasting time on unproductive activities and mismanaging money. It's essential to prioritize time and financial management to ensure long-term financial success.

How can I achieve higher returns on my investments?

To achieve higher returns, evaluate your expenses, avoid bad investments, and understand the power of compounding. By making strategic investment decisions and seeking professional advice, you can maximize your returns over time.

What are some long-term financial goals to consider?

Long-term financial goals include creating a compounding amount from investments, investing for generational wealth, and maximizing returns and wealth accumulation. Setting clear goals and understanding wealth-building strategies is crucial for long-term financial success.

Become Part of Agent Wolfpack!

Watch the full training and become part of our weekly sessions and community by joining Agent Wolfpack! Discover how our effective strategies and dedicated support can help you achieve your goals and grow your business!

Email: connorsteinbrookofficial@gmail.com

Website: www.connorsteinbrook.com

Connor Steinbrook, founder of the eXp Wolfpack Organization, brings over a decade of expertise in real estate, leading a global team of over 3,100 agents. His innovative approach and leadership have positioned him as one of the top influencers and strategic minds in the real estate industry.

YouTube Channel

Watch the Latest with

Connor Steinbrook

My name is Connor Steinbrook, and I created this channel to share my decade of real entrepreneurial experience, including building one of North America's largest real estate organizations, the Wolfpack Organization, through eXp Realty, to help entrepreneurs start, scale, and grow their businesses.